Полный отказ от алкоголя оказывает глубокое положительное влияние на физическое и психологическое состояние человека.

В вопросе о том, можно ли дарить кольцо мужчине, кроется множество нюансов, связанных с

Хорошее решение перед праздниками - купить детские новогодние подарки сладкие. Разнообразные наборы в шкатулках,

С раздражающими SMS-бомберами можно и нужно бороться: в данной статье рассказываем четыре способа, как

Почему мужчины заводят себе любовниц и что их привлекает в них? Определение женщин у

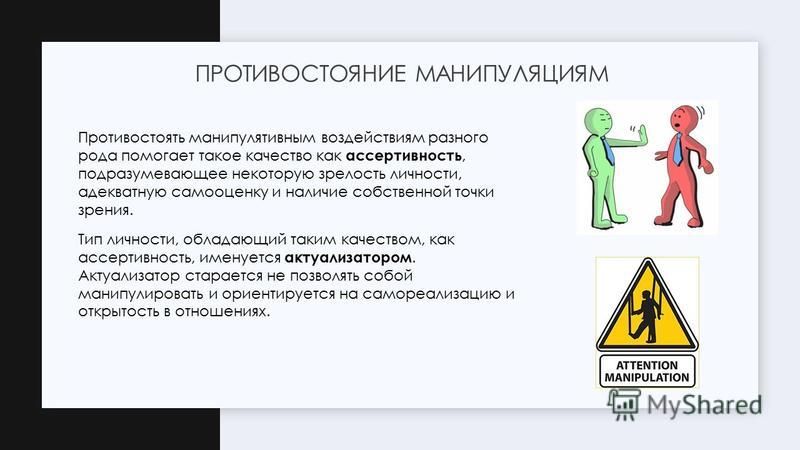

Почему мужчина пытается вызвать ревность у женщины? Что стоит за таким поведением и как

Как мужчину подтолкнуть к свадьбе намеками и вопросами. Фразы, которые подтолкнут мужчину сделать предложение.

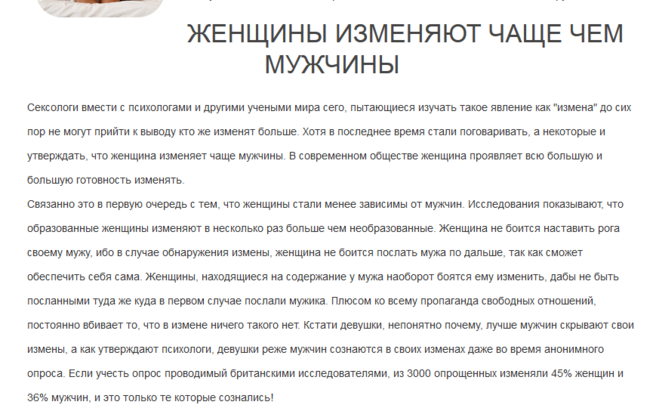

Все ли мужчины изменяют своим женам? Сколько процентов? Какие мужчины не изменяют? Статистика.

Почему мужчины изменяют своим женам, но не уходят из семьи. Как добиться, чтобы муж

Что делать, если бывший любовник хочет вернуться? И как вернуть женатого любовника, если узнала

Почему мужчина не готов к штампу в паспорте и не хочет официально оформить отношения

«Любовь нечаянно нагрянет»... От этого не застрахован никто, но что делать, если в этот

Прочитайте эту информацию несколько раз, пока не придет глубокое понимание этого важного вопроса. Осознав

Ответ на вопрос о том, как разнообразить семейные отношения, не может быть простым и

Важные рекомендации женщинам, как женить на себе мужчину, холостяка или разведенного. Что делать, если

Насколько хорошо вы и ваш партнер знаете друг друга? Мы выбрали 400 интересных вопросов,

Какие качества в женщинах нравятся мужчинам. Как заставить мужчину вас любить. ТОП 10 рекомендаций

В статье рассказывается о том, что делать, когда мужчина не ценит женщину

Если мужчина говорит женщине, что соскучился, что это значит: неравнодушие или сексуальное желание? Какие

В статье рассматриваются основные причины ознакомления с психологической литературой, ее особенности, польза для мужчин

Признание в любви любимому мужчине: в стихах и прозе своими словами, красивое, нежное, трогательное

Как устроить бюджетный романтический ужин дома для двоих влюбленных? Здесь вы найдете крутые рецепты

Мы собрали самые лучшие фильмы про измены 2020. Список фильмов про супружескую измену, предательство,

Как понять, что парень в тебе заинтересован. Почему мужчины редко признаются в романтических чувствах.

В статье расскажем, чего нельзя прощать мужчине и почему. Некоторые вещи не стоит игнорировать...